As a homeowner, managing your property serves as an essential part of preserving its value, which is particularly true for those who lease their properties to tenants. In the dynamic world of property rental, a home warranty emerges as a crucial consideration for owners seeking to shield themselves from financial burdens tied to unexpected home repairs. But what precisely is a home warranty? At its core, a home warranty is a service contract that covers the repair or replacement costs of your home’s major appliances and systems. Despite its relevance and advantages, many property owners either misunderstand or remain largely uninformed about home warranties. They often confuse it with home insurance or underestimate its practicality due to prevailing misconceptions. This knowledge gap underlines the need to explore and understand the essence of home warranties, their benefits, and how to select the right plan for your property.

What is a Home Warranty?

Understanding Home Warranty

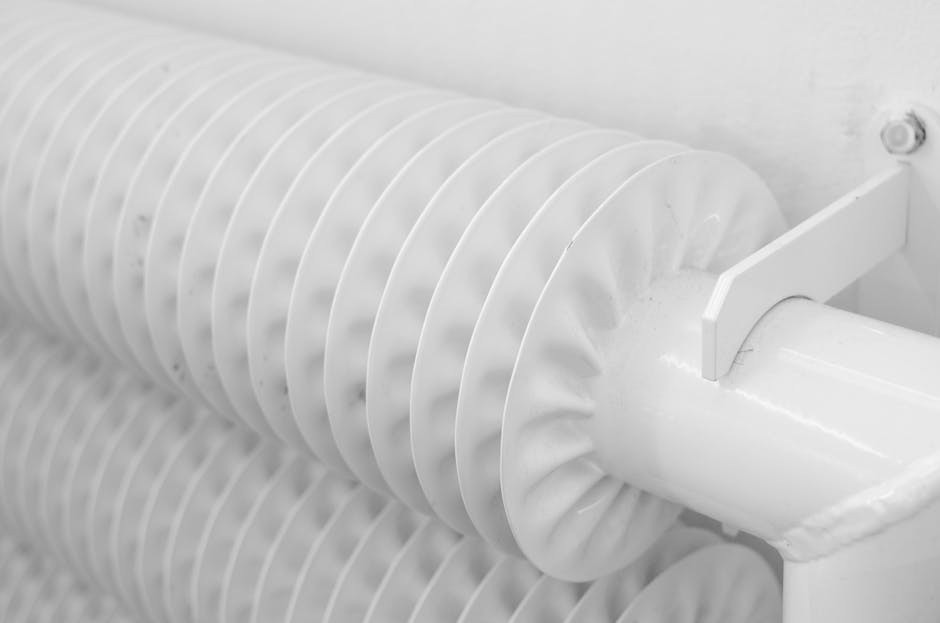

A home warranty is a service contract that covers the maintenance and repair costs of key components in a residential property, such as electrical systems, plumbing, heating or cooling systems, and appliances. Home warranty plans are designed to alleviate the financial burden of homeowners or rental property owners when crucial elements of their property require repair or replacement due to normal usage. It acts as a protection plan that, for an annual fee, provides repair or replacement services. The fee typically ranges between $300 to $600 annually, plus additional service fees for each repair visit.

Differentiating Home Warranty and Home Insurance

Contrary to popular belief, a home warranty and home insurance convey two different types of protection. While both are important, they serve different purposes. Home insurance covers damage to the property structure and personal belongings due to accidents, precluded damages, or theft. On the other hand, a home warranty covers repairs and replacements of systems and appliances that fail due to normal wear and tear.

Components Covered Under Home Warranties

A standard home warranty typically covers major systems such as heating, electrical, and plumbing, as well as appliances like washers, dryers, refrigerators, and dishwashers. The specifics of what is covered may vary based on the policy. There are also optional add-ons available for certain items not covered under the basic plan, like pools, spa equipment, and additional refrigeration units.

Understanding the Value of a Home Warranty for Your Rental Property

As a rental property owner, you’re all too familiar with the unexpected mishaps and necessary fixes that occur in any home—let alone several. These repairs, particularly if they are frequent or severe, can quickly become an expense you didn’t anticipate. That’s where a home warranty for rental properties steps in, negating surprise costs and ensuring that you only pay a service fee. The financial safeguard this provides is a boon to many property owners, ensuring that both wallet and peace of mind are protected.

This safety net also extends to tenant relations. With a home warranty in place, any repairs or replacements necessary are dealt with swiftly and professionally. This increases tenant satisfaction and retention rates, a key aspect of maintaining prosperous rental properties.

Furthermore, a home warranty enhances the overall value of the rental property. Prospective tenants, as well as property management companies, view this type of protection as a major plus, as it guarantees the proper functionality of systems and appliances within the property.

Owners who have more than one rental property will find that home warranties offer a practical and cost-efficient solution to managing these properties. It minimizes the risk of sudden, unplanned expenses associated with each rental.

However, it’s vital to remember that a home warranty is not a replacement for regular upkeep. Landlords should continue to keep appliances and home systems in good working order to avoid nullifying the warranty– plus, actively maintaining these systems can prevent unnecessary repairs.

In summary, a home warranty affords valuable coverage and peace of mind to homeowners, tenants, and property managers. This protection against high repair costs, coupled with its beneficial role in rental property management, makes a home warranty a key consideration for any property owner.

Benefits of Having a Home Warranty for Rental Property

Shielding Against Unforeseen Repairs and Maintenance Costs

One of the standout advantages of securing a home warranty for a rental property is the financial protection it imparts. When unexpected repairs and maintenance issues arise, they can significantly impact profit margins from the rental income– that is, unless you have a home warranty plan. This warranty prevents such unplanned expenses from cutting into your profits by covering a multitude of varying repairs. From problems with the HVAC system to plumbing dilemmas, a home warranty can handle a broad spectrum of fixes that otherwise would require a substantial amount of funds. With the right warranty, you could potentially save a great deal of money over time. That aside, knowing that potential repairs fall under the protection of the warranty also eliminates related stress for landlords.

Increasing Rental Property’s Market Value

Property owners can also leverage a home warranty to increase their rental property’s market value. Because a home warranty provides the assurance of problem-free maintenance and repair, the perceived value of the property increases in the market. Potential tenants may be willing to pay a premium rent for properties with a home warranty, knowing that they would not have to deal with the cost and hassle of unexpected breakdowns and repairs.

Tenant Attraction and Retention

A home warranty not only adds to the appeal of the property for potential tenants but also aids in tenant retention. It provides tenants with the comfort and security of knowing that their rental property is well-kept, and any issues that may arise will be addressed promptly. This added security can serve as a strong selling point for the property, attracting high-quality tenants. Moreover, existing tenants are more likely to renew their leases when they feel secure in their living situation, reducing the turnover rate and potential loss of rental income for property owners.

Offloading Management of Repairs and Replacement

Another, often overlooked, advantage of having a home warranty for rental property is the convenience it offers in terms of managing repairs or replacements. A home warranty company typically has a network of service providers they work with. When a covered item needs repair or replacement, the warranty company arranges for the services, thereby eliminating the need for the landlord to source and vet different service professionals. This offloading of responsibility can save landlords a significant amount of time and energy.

Protection Against Tenant Neglect or Misuse

A home warranty can provide additional protection against potential damage resulting from tenant neglect or misuse. In many cases, a warranty can cover damage or breakdowns caused by improper use, which a traditional insurance policy might not cover. This layer of protection can provide peace of mind to landlords, ensuring that their investment is safe despite potential tenant-related issues.

The Advantages of Home Warranties

A home warranty can be a game-changer for property owners and tenants alike. It’s a cost-effective approach to managing property maintenance and repairs, adds a true mark of value to the property, and plays an immense role in ensuring tenant satisfaction and keeping them in your property long-term.

Choosing the Right Home Warranty Plan

Unpacking the Significance of Home Warranties for Rental Units

The function of home warranties becomes particularly significant when dealing with rental properties. They act as protective shields for your investment and significantly decrease the risk of unforeseen costs related to substantial repairs or complete replacements of systems and appliances. Above all, they streamline the maintenance process, extending a sense of reassurance to property owners and tenants alike.

Factors to Consider in a Home Warranty Plan

When choosing a home warranty plan, there are several critical factors to consider. The first is the cost. Fees for home warranty plans can vary significantly, based on the level of coverage and the company providing the plan. As a property owner, it’s important to weigh the cost of the home warranty plan against the potential out-of-pocket expenses for repairs or replacements.

The second factor to consider is what items are covered. Not all home warranty plans cover all systems and appliances. Prior to selecting a plan, it is crucial to thoroughly review what is included and, importantly, what is not. This step ensures that the most critical and expensive appliances and systems are covered.

Service Fees and Company Reputation

In addition to the basic cost, most home warranty plans also include service fees. These are usually charges incurred for each service call. The fee amount can vary, so it’s important to review this aspect when picking a plan.

The reputation of the home warranty company is also critical. Choosing a company with positive reviews and good customer feedback can help avoid potential issues later. It is also beneficial to assess the company’s responsiveness, as immediate attention may be required for emergency repairs.

Making a Claim and Dispute Resolution

Understanding the process of making a claim is another important factor. Many warranty companies provide 24/7 customer service for claims. However, the response time and efficiency can vary.

In the event of disputes related to the coverage or service, most companies provide a resolution process. It is essential to understand this process upfront. Some companies may also offer a cancellation and refund policy in case of dissatisfaction with the service.

Deciding on the optimal home warranty plan for a rental property requires careful evaluation of several aspects. Financially speaking, it’s beneficial to consider getting a home warranty if the potential costs of repairs and replacements exceed the warranty’s cost, including service fees. Investing in a home warranty could thus be a prudent choice and offers the added benefit of peace of mind, by limiting unforeseen expenditure connected to property maintenance.

Common Misconceptions and Myths About Home Warranty

Common Misunderstanding 1: Home Warranties are Overpriced

Many people operate under the misconception that home warranties are prohibitively expensive. It’s easy to focus on the initial amount required and hastily conclude that it’s an unnecessary expenditure. However, compared to the potential pocket-draining costs associated with significant property repairs or replacements, the price of a home warranty is relatively inconsequential. For landlords managing rental properties, the cost of securing a home warranty is a minor investment towards protecting assets from unexpected damages.

Misconception 2: All Home Warranties Offer the Same Coverage

Another common misunderstanding pertains to the coverage provided by home warranties, with many people believing all companies offer identical coverage. This is untrue as coverage varies significantly between providers and even between different plans offered by the same company. Therefore, it’s essential to thoroughly examine what is covered by each plan when selecting a home warranty for your rental property.

Misconception 3: Home Warranties Cover Pre-Existing Conditions

Many people mistakenly believe home warranties will cover damages or defects existing before the warranty was purchased. This is generally not the case. Just like health insurance policies don’t cover pre-existing medical conditions, home warranties do not cover defects or problems that were present before the warranty contract was signed. As a rental property owner, it’s crucial to fix all existing issues before purchasing a home warranty.

Misconception 4: Home Warranty is the Same as Home Insurance

A widespread misconception is the equivalence between a home insurance policy and a home warranty plan. While both are crucial for practical property management, they serve different purposes. A home warranty covers the repair or replacement cost of major home systems like HVAC, electrical, and plumbing, and appliances such as ovens, refrigerators, and washers that are beyond their manufacturer’s warranty. On the other hand, home insurance covers damage or loss of the physical structure or personal belongings due to events like fire, theft, or natural disasters.

Misconception 5: You Can’t Choose Your Own Repair Technician

Some people incorrectly believe they are stuck with the repair technician assigned by the home warranty company. In fact, most companies allow you to choose your licensed contractor subject to their approval. This gives you the freedom to choose a technician you trust, especially important when managing a rental property.

These misconceptions can pose significant barriers to securing home warranties for rental properties. It’s crucial to understand the reality behind these myths and the benefits a home warranty can bring, such as financial protection from unexpected, expensive repairs or replacements and peace of mind for both the landlord and tenant.

By becoming more informed about home warranties, you can use them to your advantage, gaining the ability to protect your property, finances and maintain or increase your rental property’s value. A home warranty mitigates the risks of unexpected repair costs and enhances your property’s appeal to potential tenants. However, reckoning with common misconceptions around it can help you leverage its full potential. Keep in mind, just like any other financial decision, selecting the appropriate home warranty plan requires careful consideration of various factors including costs, coverages, vendor reputation and service fees. A well-informed decision about home warranties will contribute significantly to smoother property management and a more profitable rental business.