With the growing urgency to combat climate change and make a shift towards renewable energy sources, solar panels are increasingly being installed in residential properties nationwide. As a renter or a landlord, you might wonder about the financial implications of this eco-friendly step. Who should pay for the solar panels in a rental property – the tenant or the landlord? This inquiry leads us into an interesting mix of cost calculations, leasing agreements, legislative deficits and ethical considerations.

Understanding Solar Panel Installation

Understanding Solar Panel Installation

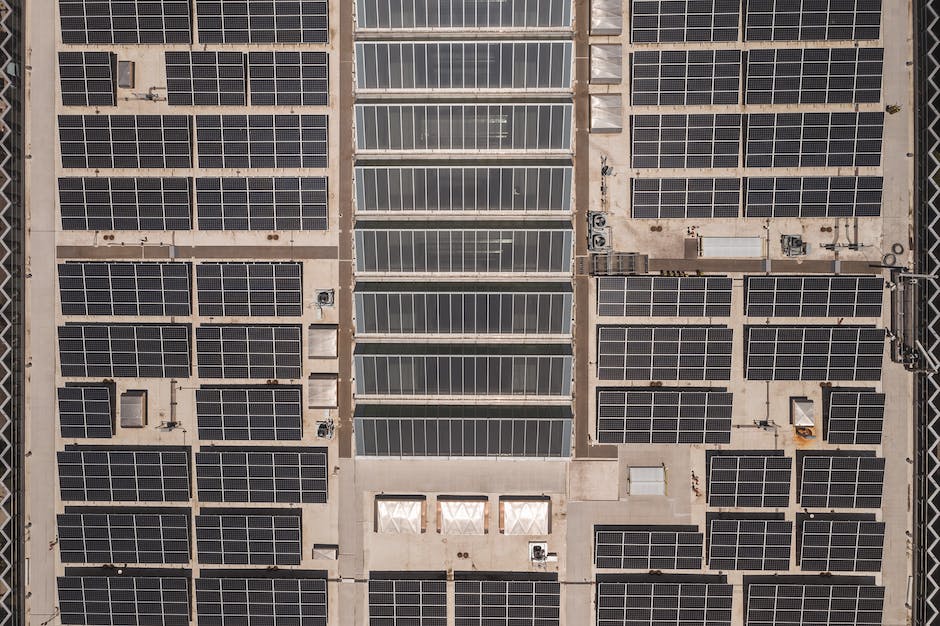

A solar panel installation involves fixing panels typically made of silicon cells on your roof or any other suitable location in your premise. These panels convert sunlight into electricity, providing an alternative and more sustainable source of power.

Installation isn’t a straightforward task. It requires a thorough assessment of the location, checking the suitability of the roof, the angle of the panels for optimal sunlight collection, and the necessary wiring and equipment for storage and conversion of solar power.

The cost of solar panel installation can range considerably depending on the specific system installed, the size of the property, and local regulations and incentives. The initial cost may appear high, but the long-term savings on electricity bills can offset the price over time. Moreover, solar panels have environmental benefits as they reduce the dependency on fossil fuels, thereby reducing carbon emissions.

Understanding the Dynamics of Solar Panel Costs for Tenants and Landlords

When it comes to the installation of solar panels on rental properties, a common query springs up about who should carry the financial burden. Is it the tenant, who will directly profit from decreased utility expenses due to the solar panels, or does the responsibility lie with the property owner?

Typically, property improvements and any affiliated costs come under the jurisdiction of the landlord. As solar panels uplift the property value while reducing energy expenditure, it is generally viewed as a property upgrade.

However, the scenario becomes complicated because the immediate benefits, in the form of smaller electricity bills, are experienced by the tenants. As such, landlords might believe it’s only equitable for tenants to share a part of the expense, or consider an increase in rent to account for the cost.

Moreover, legal factors also play a significant role. In some regions, landlords have the authority to execute ‘green improvements’ and transfer the costs to their tenants in exchange for lower utility bills. Hence, it’s plausible for tenants to bear some responsibility for paying for solar panels, often spread over time and relative to the reduction in utility fees, rather than as a one-time payment.

Additionally, the rental agreement or lease should explicitly state if landlords intend to pass on the solar panel costs to tenants. Tenants, for their part, should thoroughly peruse any agreements and ask for clarifications regarding such provisions before entering into a contract.

It’s worth noting the availability of financial incentives and programs in many states to promote the adoption of green energy sources. These initiatives can decrease the costs for landlords substantially, making the solar panel installation more appealing without necessarily passing the costs to the tenant.

In conclusion, the matter of who foots the bill for solar panel fittings on a rental property is subject to a variety of factors such as local laws, the specific rental contract, and the overall utility and improvement policies of the property.

Solar Panel Costs and Leasing Agreements

A Closer Look at Solar Panel Leasing Agreements

Solar panel leasing agreements represent a contract between a solar panel leasing company and a property owner. Here, the company assumes the role of installing, maintaining, and overseeing the solar panel system on the property owner’s premises for a prescribed duration, typically around 20 years. In return, the property owner agrees to a fixed monthly lease fee, often lower than their existing electricity bill. Hence, with the potential increase in electric costs and stationary lease payment, owners may realise substantial savings over time.

Who Bears The Financial Burden?

Typically, the financial burden of solar panel installation, maintenance, and monitoring falls on the leasing company. The homeowner only pays the agreed-upon monthly lease fee. However, the structure of the lease agreement can affect who actually pays these costs. For instance, a lease agreement may include an escalation clause, which allows the lease payment to increase over time. In such a situation, the homeowner might end up bearing a higher financial burden as the years pass.

Cost Shift Conditions

There may be certain conditions in a lease agreement that shift some solar panel costs to the tenants. For example, the landlord might include a clause in the lease agreement stating that the tenant is responsible for any increase in property taxes due to the solar panel installation. Another possible scenario is that the landlord might pass on any savings from reduced electricity bills to the tenant, but also add a surcharge to the rent to recoup the cost of financing the solar panels.

Real-World Scenarios

In some real-world scenarios, landlords have passed on the cost of solar panels to their tenants. For example, in California, where solar power is widely used, some landlords have increased rent to cover the cost of solar panel installation and maintenance. This can be controversial, particularly if the tenant is not seeing savings on their electricity bill.

On the other hand, other landlords have decided to bear the cost of solar panel installation themselves. They see it as an investment that increases the value of their property. The tenants benefit from lower electricity bills, while the landlord enjoys an increased property value.

Legal View

From a legal point of view, whether tenants should pay for a landlord’s solar panels largely depends on the lease agreement. The tenant should thoroughly read and understand the lease before signing. If any increase in rent or additional charges related to the solar panels are not explicitly stated in the lease, the tenant may not be legally obligated to pay for them.

Discussing if tenants should fund their landlord’s solar panels is a complex matter, with varied answers depending on the individual circumstances.

Legal and Ethical Aspects of Solar Panels in Rental Properties

Navigating Solar Energy in Rental Homes

To have an informed discussion about solar energy in rented homes, it’s crucial to understand how solar systems operate. Solar panels, once installed on a property, take sunlight and transform it into electrical power. This energy can be used to supply the household, minimizing its need for conventional electricity. If the solar system has an exceptional production, generating surplus power, this excess energy could be transferred back to the grid. This process often results in a credit for the property.

The Legal Aspects

The question of who should pay for the landlord’s solar panels can be legally complex. Generally, the landlord would pay for the installation and maintenance of the solar panels as they are a part of the property. However, the question of who benefits financially from the panels can be more contentious.

Some jurisdictions may have laws that explicitly state the landlord cannot charge extra for solar power generated above and beyond what the property would typically use. In other areas, the rules may be less clear.

If the tenant’s lease includes utilities, then it might be expected that the tenant benefit from the reduced power bill resulting from the solar panels. The landlord could potentially increase the rent to cover the cost of the panels, but this could be seen as an unfair practice.

State and Federal Laws

Each state has different laws regarding solar energy in rental properties. It is vital to research your specific state’s statutes and consult with a legal professional if necessary. On the federal level, a tax credit is available for homeowners who install solar panels, which can offset some of the costs. However, landlords may not pass this cost onto their tenants.

Fair Practices and Ethical Considerations

While legal considerations are important, ethical questions around charging tenants for solar panels are also worth discussing. From an ethical viewpoint, many argue that it is unfair for a landlord to pass on the cost of a property upgrade like solar panels to the tenant, particularly if the solar panels were installed for the landlord’s financial gain or tax benefits.

However, if the installation of solar panels leads to significant energy savings for the tenant, some might argue that it’s reasonable for the tenant to contribute towards the solar panels’ cost. This perspective is less common and not universally accepted, as many believe that an upgrade benefiting the landlord, such as increasing property value, should not result in additional financial burdens for the tenant.

Deciding Who Pays

The decision on who should shoulder the cost for a landlord’s solar panels isn’t one that’s uniformly agreed upon. Different factors may influence this decision, such as the lease agreement’s specific terms, existing local legislation, and ethical considerations. As it’s a potentially complex legal question, it might be prudent to seek advice from a legal or real estate professional.

The Landlord-Tenant Solar Panel Cost Debate

Costs and Benefits of Solar Installation

Typically, landlords consider the option of solar panel installation to help cut down on energy expenses, increase the market value of their property, and make a positive environmental impact. But these benefits come with a significant upfront investment. The cost of solar panel systems ranges between $15,000 and $25,000 – a figure that doesn’t account for potential maintenance and repairs. Even after factoring in potential federal tax credits and utility incentives, the total financial burden for landlords is substantial.

The Cost Debate

The question of whether tenants should help in covering these costs is the root of the debate. Some argue that if a tenant benefits from lower energy costs due to the solar panels, they should contribute to the cost of the system. After all, they would be paying for electricity anyway, and with solar panels, they’re likely to be spending less on this.

From the landlords’ perspective, they see the installation of solar panels as similar to any other capital improvement to the rental property. Just as landlords would pay for a new roof or a furnace, they see themselves as responsible for the solar panel system’s costs.

Pros and Cons

For tenants, contributing to the solar panel cost could mean a slight increase in their rent. However, this could be counterbalanced by the reduction in their monthly utility bills. Additionally, by contributing to the solar panel cost, they are investing in a renewable energy source, which could be seen as a positive for those environmentally conscious.

On the downside, if the solar panel system doesn’t produce as much energy as anticipated, tenants may not see any significant savings in their utility bills and would feel disadvantaged paying for something without proportional benefits.

On the landlords’ side, if tenants contribute financially to the solar panel system, it could help them recoup their initial investment faster. However, this could be a balancing act as raising the rent might make the property less desirable to potential tenants, no matter the potential energy savings.

Another aspect to consider is the maintenance and durability of the solar panels. If they break down or need replacement, who would shoulder the cost? If tenants had contributed to the cost initially, they might feel it’s unfair to pay for repairs and maintenance too.

Legal Considerations

It’s also essential to bring up the legal aspect regarding who’s responsible for paying for a landlord’s solar panels. As it stands, there seems to be no clear-cut legal guideline regarding this issue. It largely depends on the tenancy agreement and local and state laws.

For instance, in some lease agreements, it’s stated that tenants will pay a ‘solar service charge’ or a ‘solar rental charge.’ This explicitly sets up the tenant’s responsibility to contribute to the solar panel costs. However, it must be stated clearly in the lease agreement, and both parties should agree upon it.

In conclusion, whether tenants should pay for a landlord’s solar panels depends on multiple factors, including the tenancy agreement, potential benefits to the tenant, and ethical considerations. What’s clear, though, is that this issue necessitates open, clear, and fair communication between landlords and tenants. While solar panels can offer several benefits, how to share the costs is something that each individual landlord and tenant will have to decide.

In essence, the question of who ought to bear the cost of solar panels in rental properties remains complex, governed not only by leasing agreements, but protracted legal and ethical considerations. For landlords, it’s an effective way to enhance the value of their properties and possibly yield a return on their investment through electricity savings. Tenants, too, can potentially enjoy reduced utility bills, making solar panels a win-win. But the balance shifts considerably when the costs become a burden for the tenants. More standardized rules and ethical guidelines addressing this aspect may be required to make it more equitable. Opinions vary, but the consensus leaned towards creating a balance that is beneficial and fair for both parties.