Property liens might sound like a dry topic reserved for the courtroom, but they hold significant sway over the financial and personal lives of tenants and landlords alike. This discussion sheds light on how property liens function as a tool for rent recovery, their impact on all parties involved, and alternative solutions for managing rent debt. By understanding these aspects, individuals can better prepare for and respond to the challenges that come with property liens.

Understanding Property Liens

A property lien is a legal claim against the assets of an individual or business that owes money. When tenants fall behind on rent, landlords in Prince George's County, MD, can use this as a method to secure payment. Think of it as a legal safety net that ensures debts aren't just swept under the rug.

Placing a lien involves a few steps:

- The landlord must obtain a judgment from a court acknowledging that the tenant owes rent.

- This judgment is then used as the basis for requesting the lien.

- The court issues a notice to the debtor, informing them about the lien.

There are different types of liens, but for rent recovery, the most likely to be used is a judgment lien. This lien attaches to a tenant's property, such as vehicles or real estate, depending on what assets the tenant owns.

Once the lien is in place, it doesn't mean instant payment; it means the landlord has a legal claim to the property equivalent to the debt's value. For tenants looking to sell their property, they usually need to settle this debt for the property transaction to go through smoothly. It can even affect tenants' ability to borrow money, making it a potent tool for rent recovery.

Certain properties might be exempt from liens, so it's key for landlords to understand the specifics of what can and cannot be encumbered by a lien based on local laws and regulations.

Releasing a lien occurs once the debt is settled. The court needs to be notified to ensure legal documentation accurately reflects the debt resolution, removing any legal claim from the tenant's property.

This process doesn't just pull the rug out from under debtors; it also places a considerable responsibility on landlords to navigate the process thoroughly and legitimately. Going the lien route for recovering rent requires patience and attention to legal procedures, but for many landlords in Prince George's County, it emerges as an effective solution in ensuring debts are paid.

Legal Process for Filing a Lien in Prince George’s County, MD

To kickstart the legal process of filing a property lien for rent debt in Prince George's County, MD, landlords need to secure a court judgment declaring the tenant owes rent. This is obtained by filing a lawsuit in the District Court of Maryland for Prince George's County. The journey begins with the landlord submitting a failure to pay rent form, detailing the rent amount overdue and any additional charges permitted by the lease agreement.

Once the court schedules a hearing, both landlord and tenant receive notification to appear in court on a specific date. During this hearing, the landlord explains their case, showing evidence of the unpaid rent and attempts to collect it. Evidence may include:

- A copy of the lease agreement

- Rent notices

- Communication records between the landlord and the tenant

If the judge rules in favor of the landlord, they issue a judgment for the outstanding rent. This judgment serves as the foundation for the lien process, offering legal confirmation the tenant owes the landlord money. Following the judgment, the landlord proceeds to file a request for a lien with the county court, providing necessary documents such as the court judgment proving the tenant's debt, a description of the tenant's property, and indicating that traditional collection efforts have been unsuccessful.

The county's legal system reviews the lien filing for compliance with local laws, ensuring all paperwork is complete and accurately portrays the debt scenario. If approved, the lien is officially placed on the tenant's property record. This legal step makes it challenging for the tenant to sell or refinance the property without first addressing the unpaid debt.

Recording a lien requires attention to detail – every piece of documentation must be clear and precise. Landlords use official forms from Prince George's County to file a lien, ensuring adherence to specific guidelines set out by local legislation, which might necessitate format or information requirements unique to the county.

A filed lien has its own lifecycle, often extending several years. If the tenant decides to clear the debt, landlords must act promptly to release the lien from the property record; this step is vital to maintaining goodwill in landlord-tenant relations and adhering to legal obligations.

Throughout this process, landlords have responsibilities. They must handle tenant's private information with care, follow legal guidelines strictly, and stay objective despite possibly strained relations. Filing a lien isn't just a powerful tool in recovering debt – it symbolizes landlords' rights being respected within the legal framework provided by Prince George's County.

Tenant Rights and Protections

Knowing where to start when a property lien for unpaid rent threatens your living situation can be tricky. But, fear not; let's shed some light on how you, as a tenant, can stand your ground.

Tenants have the right to receive notice before a lien is placed. It's not like one day you're enjoying your favorite Netflix binge, and the next, you're slapped with a lien out of nowhere. Typically, you'd get a heads-up giving you time to brace or respond.

Courts often serve as the middleman in these situations. They don't just take the landlord's word for it. You get a say, and if your landlord's claims are more Swiss cheese than solid, you could swing the verdict in your favor.

Contesting a lien doesn't require you to be a legal eagle. Sometimes, just presenting proof of payment or highlighting errors in your landlord's claim can tip the scales. Authentic receipts and bank statements become your best friends.

Negotiation isn't just for business moguls. You can sit down with your landlord and hash out a deal or a payment plan that works for both of you. Maybe you agree on a lesser amount or spread payments to ease the financial burden, keeping that lien at bay.

Seeking help from local tenant associations or legal aid services makes a world of difference. They know the ins and outs of tenant rights and could offer advice or representation, ensuring you're not going this alone. In Prince George's County, organizations like Community Legal Services of Prince George's County and the Maryland Legal Aid Bureau provide free or low-cost legal assistance to eligible tenants facing property liens.1,2

Beware of harassment. Your landlord might think scaring you into paying is the way to go. Know this: using a lien or the threat of one to bully you breaches many local laws. Stand your ground and report such behaviors.

If that lien does get placed unfairly, channels exist for removing it. Proving the lien's illegitimacy or settling the rent debt clears your record, freeing your property from the clutches of that dreaded lien.

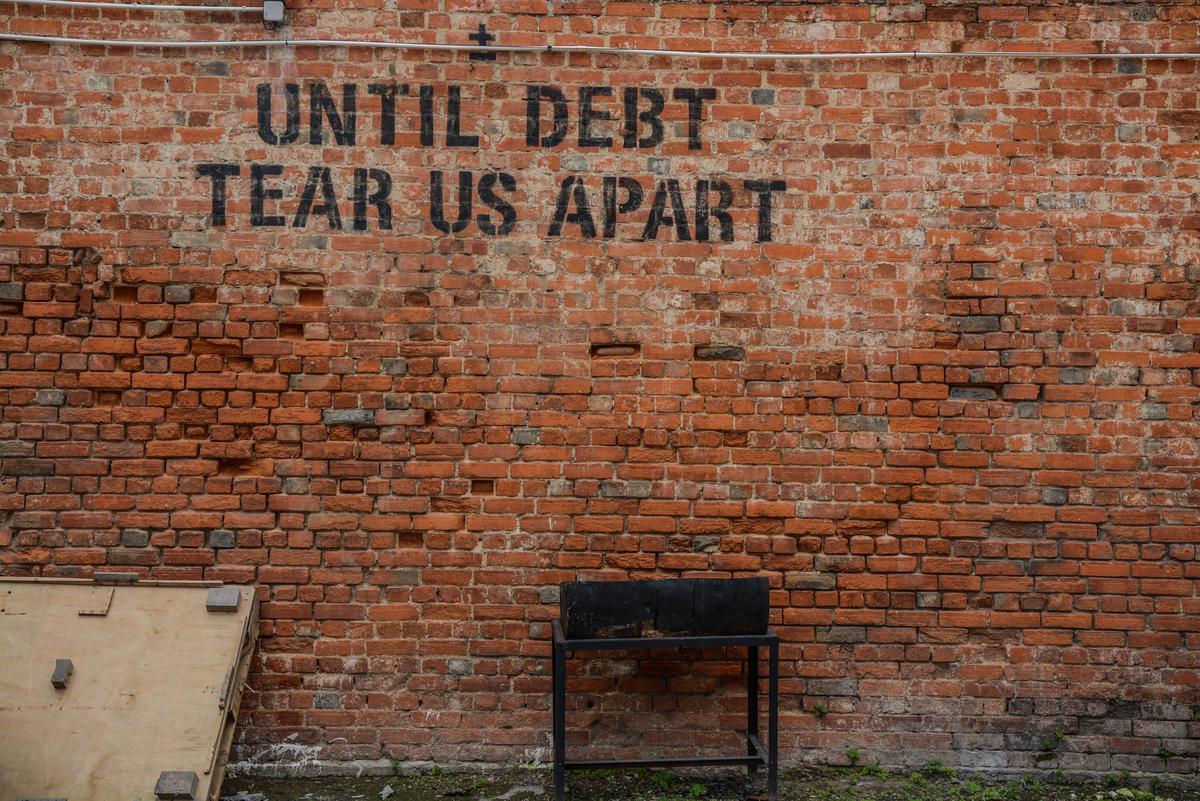

Photo by alexblock on Unsplash

Impact of Property Liens on Tenants

Once a lien is placed on a tenant's property for rent debt, the impacts can trickle down affecting not just the immediate living situation of the tenant but their financial health and rental prospects long-term. The imprint left by a lien can be etched into a tenant's credit report, lowering their credit score significantly. A lowered credit score might seem like just a number until one tries to rent another property. Landlords often run credit checks, and a blemish such as a property lien can make securing future housing a strenuous task.

The stress doesn't stop there. Tenants cradling the weight of a property lien often face financial strain. The presence of the lien might block any attempts to refinance or sell assets, squeezing them into a tighter spot where funding options are limited. This kind of financial strain can ripple out, affecting their ability to secure loans; or even in some dire cases, maintaining basic utilities that rely on a healthy credit score for contracts.

Navigating day-to-day life with the shadow of a lien overhead can turn from challenging to daunting. While the immediate repercussion might be an uncomfortable conversation with landlords or an urgent legal battle, the long-term effects dip into everyday life choices and financial freedom. From negotiating future rental agreements under the heavy air of uncertainty to rethinking financial steps to avoid exacerbating the credit situation, the existence of a lien becomes somewhat of a cumbersome chain that tenants drag along, potentially for years.

Property liens for rent debt cast a longer shadow. They entail spending more resources, both time and money, to clear off. The process demands strong financial literacy and an understanding of one's rights as a tenant to navigate effectively. What compounds the trouble is the pressure it puts on social relationships. Financial strain is notorious for causing rifts, straining family ties and friendships, especially if tenants need to borrow funds to clear the lien, yet have tarnished credit scores.

In attempts to escape their predicament, tenants caught in this spiral must negotiate not only with their current landlord but possibly face future landlords with meticulous explanations and proofs ensuring them of financial reliability despite past missteps signified by a lien. Options like securing cosigners for future rentals become increasingly important yet difficult options in salvaging what's left of renting prospects.

What's poignant in the journey of dealing with a property lien, though primarily legal and financial, entwines tightly with personal wellness and future planning. Every step, from smoothing over a tear in credit reports to reinstating faith in future landlords, evolve into lessons ingrained far beyond the initial court claims for unpaid rent. This trajectory semaphores a glaring warning – the effects of a property lien for rent debt sculpture not just present struggles but carve lengthy chapters of battling repercussions, invisible yet weighty, pulling tenants back again and again into cycles of recovery and negotiation long after the debts are settled.

Resolving Rent Debt Without Liens

Jumping into the fray of rent debt without the heavy hammer of a property lien, let's explore those paths less traveled, promising resolution and peace. Sometimes, simple communication opens doors that legal actions might not. Sitting down for a hearty chat, landlords and tenants can bring to light issues fueling rent non-payment, forging solutions simply out of understanding.

The good old-fashioned payment plan offers a lifeline to those tenants drowning in unpaid rent, allowing them to catch up slowly but surely. Settling on agreeable terms might be akin to finding a needle in a haystack; however, collaborative efforts often yield a tailored payment schedule, both practical and manageable.

Ever heard of mediation? It's like that wise uncle in family squabbles, guiding both parties through a maze of disagreements toward mutual consent without all the legal jargon and ice-cold courtroom stares. Through mediated negotiation, landlords and tenants have the space to voice concerns, hatch out compromises, and embrace settlement over strife. In Prince George's County, the District Court of Maryland offers a free mediation service for landlord-tenant disputes, providing a neutral third party to facilitate negotiations and help reach mutually agreeable solutions.3

What if we approach rent like a loan, considering interest-free loans from landlords to cover rent delays? Viewing rent arrears as a short-term loan could facilitate easier payback options, casting landlords not just as property owners but as supportive allies in tenants' times of need.

Another testament to human creativity in solving financial dilemmas is temporary rent reduction or deferment. In unusual circumstances, knocking a bit off the rent or pushing payment deadlines outwards provides that much-needed breathing room for tenants to regroup financially.

Dare we talk barter? Yes, exchanging services for rent isn't stuff of prosaic tales but tangible reality in today's flexible economy. Tenants can offer up their skills – painting, gardening, repairs – in lieu of cash rent payments. It makes for an engaging way to address rent issues while fostering community and collaboration.

Lastly, there's always room for re-negotiating lease terms. Markets change, circumstances shift; what once seemed set in stone might now warrant a revisit. It could be as straightforward as adjusting lease lengths, rental rates, or understanding temporary halts in payment as both parties look ahead towards more stable times.

Navigating unpaid rent waters needs no lien to anchor down tenant-landlord relationships. Far from it, exploring alternative paths builds bridges; brick by brick, toward financial resolution and retained dignity for all involved.

Photo by stri_khedonia on Unsplash

In conclusion, while property liens serve as a critical mechanism for landlords to recover unpaid rent, their far-reaching effects on tenants highlight the importance of seeking alternative resolutions whenever possible. The key takeaway is the value of communication and negotiation in preventing and resolving rent debt, thereby avoiding the need for such legal measures. This approach not only preserves financial health but also maintains the integrity of tenant-landlord relationships.

- Community Legal Services of Prince George's County. Eviction Prevention.

- Maryland Legal Aid Bureau. Housing & Consumer Rights.

- District Court of Maryland. Alternative Dispute Resolution (ADR) Program.